LEAD GENERATION FOR

EQUIPMENT FINANCING COMPANIES

Fuel Your Growth with Trackable, Repeatable Equipment Financing Lead Generation

As a former acquisition marketing specialist for a large equipment financing company I know the downsides to the typical lead generation channels. Cold calling is inherently inefficient, lead aggregators sell leads multiple times to your competitors, email effectiveness is waning and direct mail is all but dead. So what can you do?

Consider the fact that there are 5.6 billion searches on Google every day. Or that users spend over 23 hours per week online surfing and searching for products and services. Combine that with the ability to derive your prospect’s intent based on the words and phrases they use to search Google and you have the holy grail of marketing.

What is the Holy Grail of Marketing?

The ability to target a prospect the moment they come into market to finance equipment where you can track your performance and repeat your success. That is exactly the opportunity paid search marketing provides.

How Much Lead Volume is Available?

The amount of prospects searching for equipment financing online varies a bit depending on what you are targeting. In short, there are thousands of searches happening every day.

So much so, that even our clients with the largest budgets cannot target them all. Leverage the search engines to scale your sales team and keep them fed with a non-stop flow of in-market prospects to convert into funded deals.

How Much Funded Volume is it Possible to Generate?

Established programs have historically funded up to $24M per year in acquisition deals, with more coming from follow-on retention deals and vendor flips. Ultimately programs are only limited by the budget and manpower of your sales team. We’ve yet to hit the ceiling on what is possible.

What Size Equipment Financing Company Works Best for this Channel?

It’s incredibly hard to manage both your business and lead flow if you are a one person operation. Plus, you will need to carry your monthly ad-spend as deals move through the pipeline. We recommend our client companies have a minimum dedicated sales team of 3-5 people and are looking to scale up and grow.

We’ve spent the last 15 years generating tens of thousand of leads and millions in funded volume for equipment financing companies by building exclusive paid search marketing lead generation programs, and we can do it for you too.

Schedule Your No Obligation Consultation

How Many Businesses Search for Equipment Financing on Google?

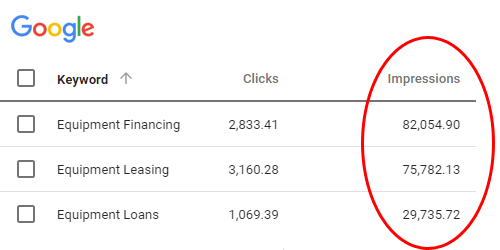

The fact is, your prospects are searching for equipment financing online every day, and in droves. Below is some data straight from Google to give you a sense of the opportunity in front of you.

That’s right, for just the three search phrases listed here, Google estimates over 185,000 related searches (impressions) in one month across the United States. One month!

In addition to general phrases like ‘equipment financing’ or ‘equipment loans’, you can also target industry related searches like ‘construction equipment financing’ and equipment related searches like ‘box truck financing’, ‘skid steer financing’ and more to target the types of equipment you finance best.

Imagine how much wasted productivity you can save when your sales team is having meaningful conversations with self identified in-market-now prospects looking for equipment financing instead of non-interested parties.

Contact us today to schedule a time to talk talk about how you can leverage paid search marketing to drive in-market prospects into your sales funnel and increase your funded volume.

HELPFUL RESOURCES

- Paid Search Marketing (A.K.A PPC or Pay Per Click Marketing)

PROS: Tractable, repeatable and ROI positive. These three attributes are the holy grail of marketing. You can target in-market-now prospects based on intent by what they are searching for, right at the moment they are indicating they need it.

You can control your messaging yet change it quickly, get to market quickly and control your spend. This means financing companies of all sizes can compete. It’s tractable from every penny you spend to every penny you make. And it’s repeatable, providing a solid lever you can pull year after year to grow your business.

CONS: By far my favorite channel, but it’s not without a downside. You need a skilled professional that understands both the financing world and how to use the paid search marketing tools. There are up front costs to get everything set up and running. And you need a budget to fund the advertising spend.

*To be clear, we are talking about search marketing, not display or banner marketing. It’s a dirty little marketing secret, but unless you are after fleeting eyeballs, display and banner marketing is among the worst ROI channels that exist.

- Most agencies work apart from your internal marketing and sales teams, acting as an autonomous resource.

We prefer to take a different approach by integrating heavily with your internal team to improve our knowledge of what equipment your company prefers to finance and the programs that define your competitive differentiators.

Plus, we offer a discounted hourly rate with a built-in commission on funded volume or profits so that we are all moving in the same direction. Towards more funded volume and a positive return on investment to grow your financing company.

- Every investment comes with some risk. And most agencies cost a fortune to work with. That’s why we created a 90 day trial lead generation program for equipment financing & leasing companies and brokers.

We are able to offer a reduced hourly rate plus a cap on your labor and ad spend costs due to our unique partnership model.

This way you can test your way into the lead generation program and reinvest with success, with a known cost cap to reduce your exposure to risk!